Quickbooks Transaction No Reads Recon but I Cannot Apply Payment to the Invoice

Configuring QuickBooks

By integrating your QuickBooks Online account with Chargebee, yous tin automate the synchronization of Invoices, Customers, and other data from Chargebee to QuickBooks, that are crucial for your fiscal direction and analysis.

We recommend that you consult your accounting advisor before configuring the integration. You can test the integration on the Test Site earlier setting up the integration on the Live Site.

Prerequisites (to be verified in Chargebee)

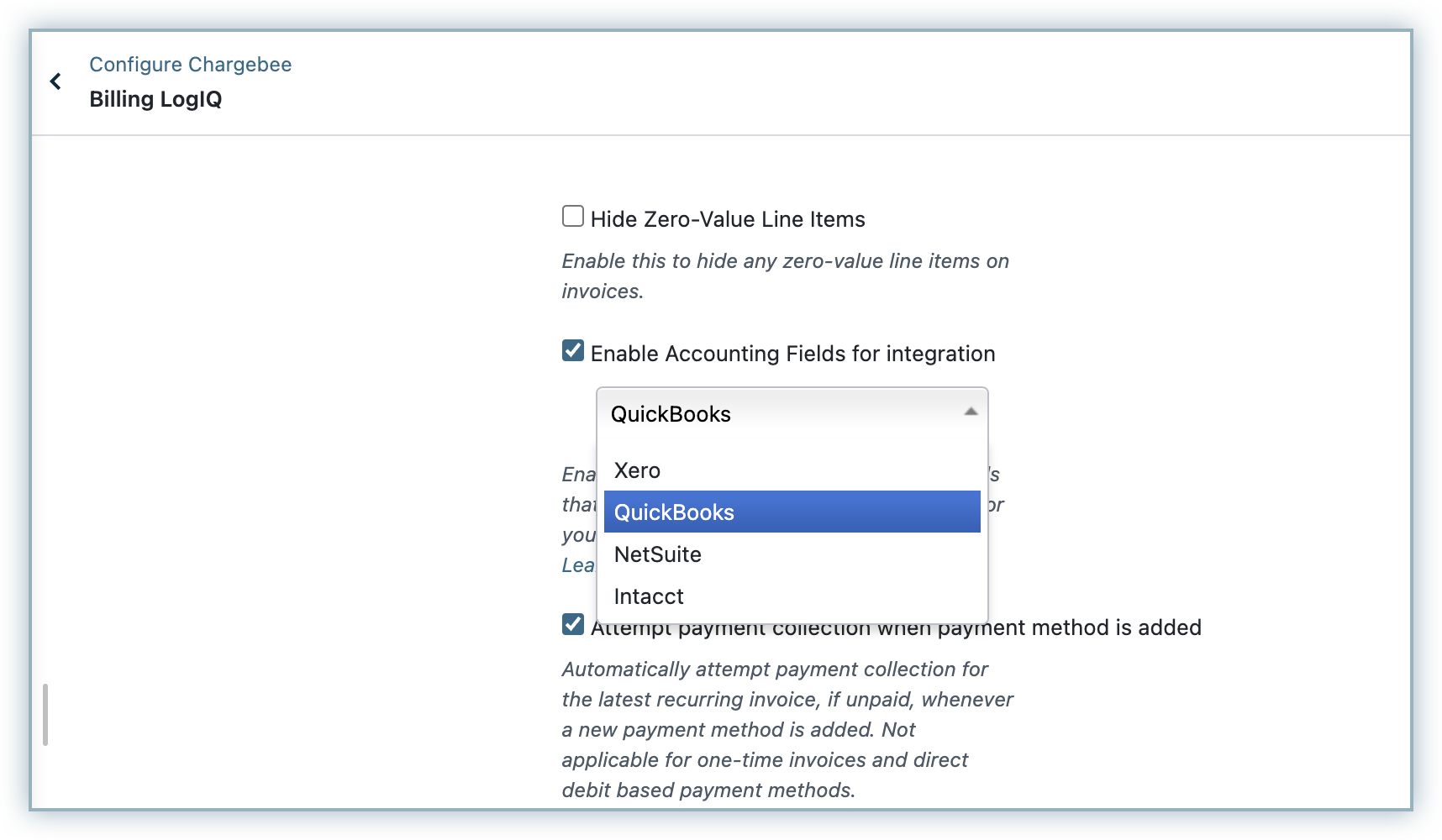

Enable Accounting Fields

Ensure that yous have enabled Accounting fields for QuickBooks. Y'all tin enable this by navigating to Settings > Configure Chargebee > Billing LogIQ.

Setup your Production Catalog

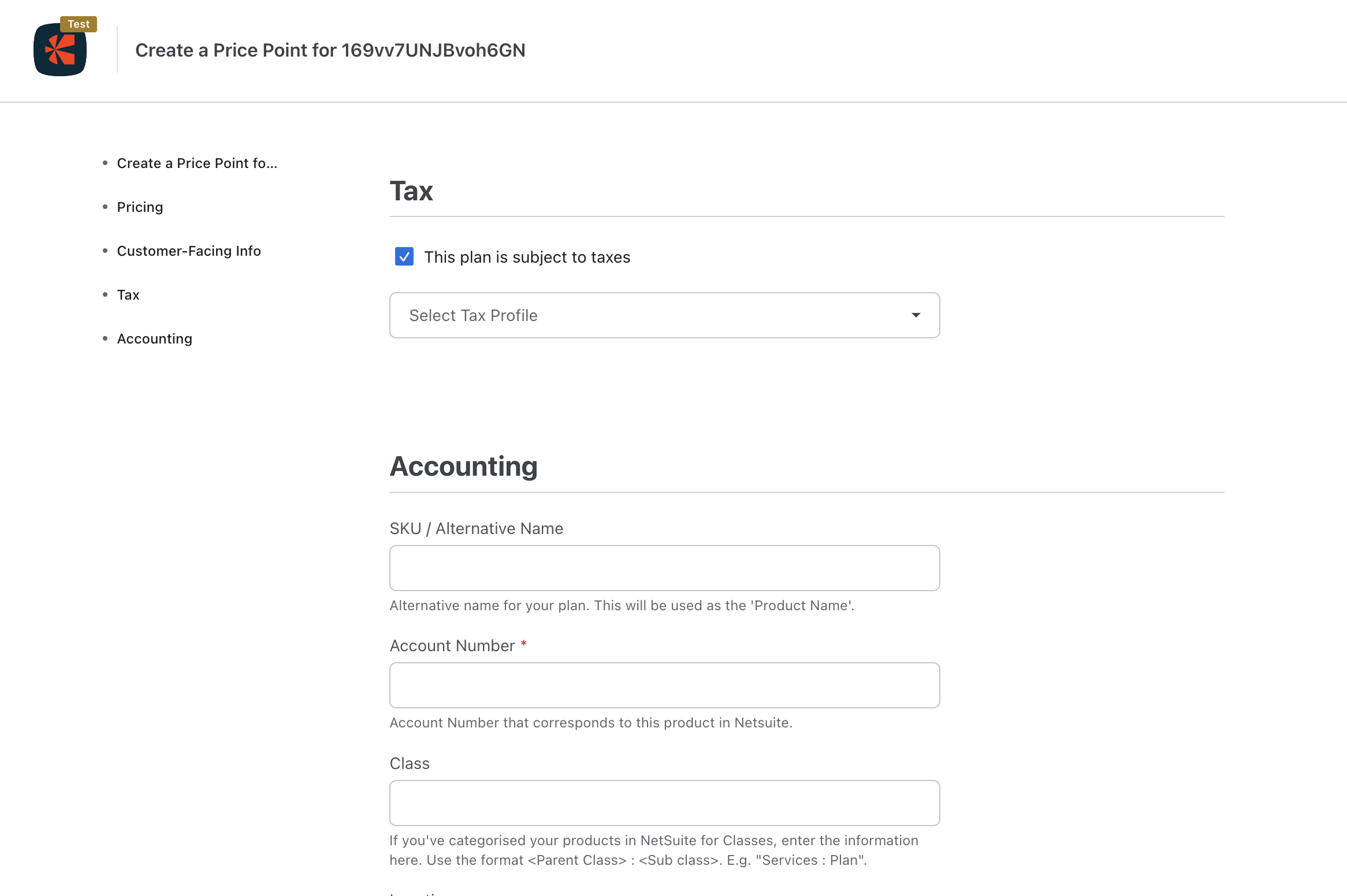

Enter accounting fields for the Plans and Addons in Chargebee:

-

SKU - You lot can enter a Product name/ SKU here and this will exist used as Product/ service name in QuickBooks. If a production/ service is already present in QuickBooks, Chargebee maps the product to the existing product in QuickBooks and new production is non created.

-

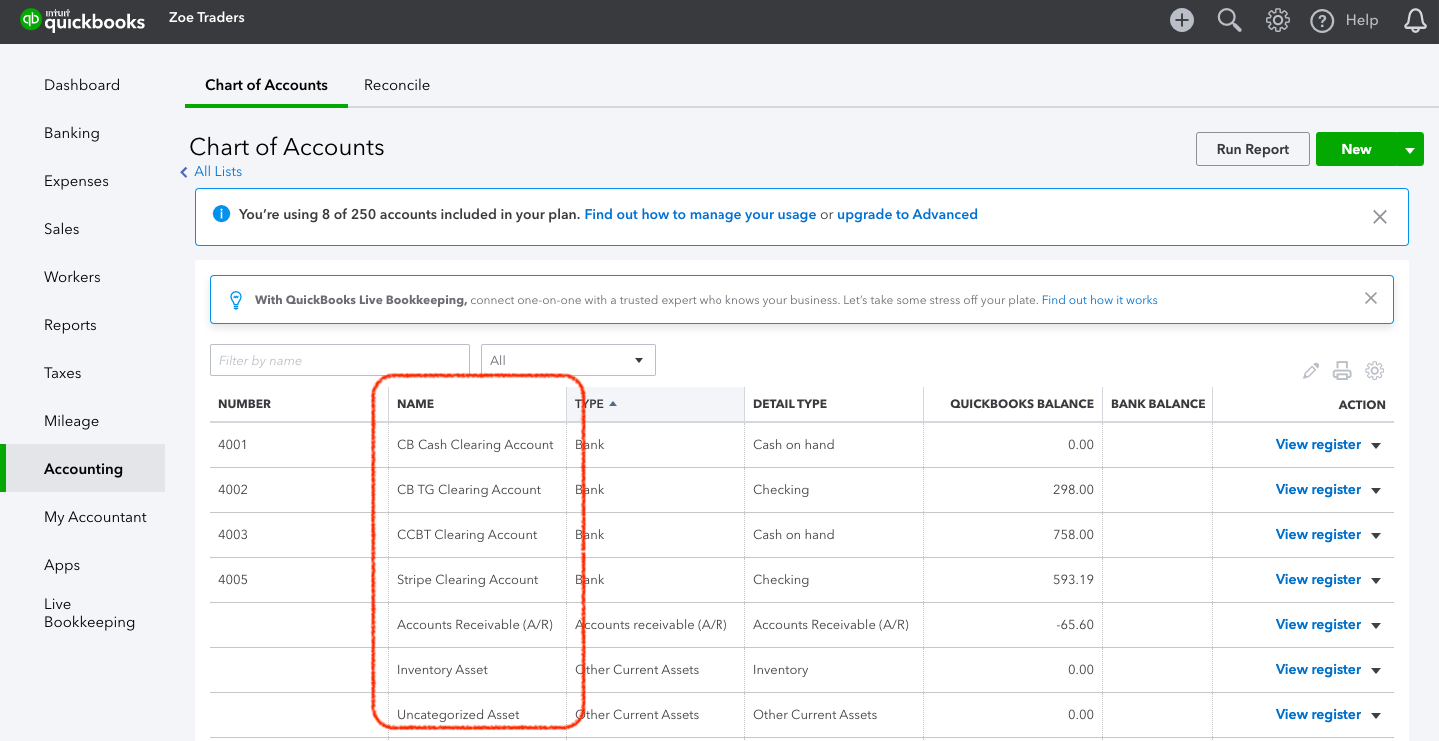

Account Proper noun - The Sales/Revenue GL Business relationship Proper noun in QuickBooks should be entered here (the field is shown in the screenshot below from QuickBooks Nautical chart of Accounts).

-

Class - If Tracking category is required for Programme/Addon price point, the Class can exist entered here. Form tracking at customer level too is possible, contact [e-mail protected] to ready this up.

Caution!

- When you add new plan/addon toll points in Chargebee anytime after the integration is set upwardly, do not forget to enter the SKU and GL Account Name fields.

- If you make whatsoever changes to the GL Account Proper noun in your QuickBooks business relationship anytime afterwards the integration is ready, yous need to update them in Chargebee likewise. Declining to do then could lead to a sync mistake.

Check Currency Settings

Verify the post-obit rules:

- The base of operations currency in Chargebee and QuickBooks should be same.

- If y'all have multiple currencies enabled in Chargebee, then yous should ensure these currencies are enabled in QuickBooks likewise.

Y'all tin can view the currencies in Chargebee by navigating to Settings > Configure Chargebee > Currencies.

Prepare up Organization Address

Ensure that yous have provided your arrangement address in the Chargebee site. You can do this by navigating to Settings > Configure Chargebee > Business Contour.

Prerequisites (to be verified in QuickBooks)

Disable "Automatically Utilize Credits" option in QuickBooks

Navigate to Settings > Visitor Settings > Advanced > Automation > Automatically Apply Credits in QuickBooks and disable the "Automatically Apply Credits" choice. This is to ensure that QuickBooks does not apply credits automatically and expect for details to exist synced from Chargebee.

Enable "Custom Transaction Numbers"

Navigate to Settings > Company Settings > Sales > Sales Class Content in QuickBooks and enable "Custom Transaction Numbers" option, to ensure that the invoice number, credit note number is created as created in Chargebee. Additionally, if you are generating invoices manually in QuickBooks, the invoice number sequence will non be disturbed.

Best Practise

Apart from enabling "Custom Transaction Numbers" in QuickBooks, you tin utilize invoice/credit annotation numbering customization settings in Chargebee to add a dynamic prefix. This will help avoid errors on duplicate document number during the sync.

Configuration

1. Connect

To connect to QuickBooks, get to Apps > Become to Marketplace > Accounting > QuickBooks. Click Connect and link your QuickBooks Online account.

2. Verify Bookkeeping Information

One time you lot have authorized your QuickBooks account, Chargebee will bank check whether your plan/addon toll points have a valid GL Account Name. Price points that don't take the Account Name volition exist listed.

You tin can download the CSV file to add the accounting data for all price points, by following these steps:

- Click Set via CSV and download the CSV file.

- Open the CSV file and update the post-obit information for all plan/addon price points:

- SKU: This field is used to map the existing items from QuickBooks to the corresponding plan/addon toll point in Chargebee. It can be used as an alternative name for the price point and its grapheme limit should not exceed 30 characters.

- Accounting Lawmaking: Depending on the Accounting type you select in the previous footstep, the Accounting lawmaking field should be filled for all the price points.

- Item GL Group: Yous tin optionally insert a new column named Item Gl Group, and add the name field of the Particular GL Groups used for the corresponding plan and addon toll points.

One time you lot update the details, save the file and click Upload CSV to upload the file back into Chargebee.

3. Prerequisite Bank check

Once you have authorized your QuickBooks account, Chargebee will perform compatibility checks to ensure the invoices don't fail later when the invoice sync has started. The list of checks are:

a. Chargebee invoices present in QuickBooks already: If invoices from Chargebee are already created in QuickBooks manually, customers will be present also. In gild to avoid duplicates, you should map the client records between both the systems.

Yous can download the CSV file, map the customers and upload the updated file in Chargebee. If there is no possibility of duplicates, you lot tin ignore and proceed.

b. Currency check: The list of currencies enabled in Chargebee should be enabled in QuickBooks equally well. For instance, if USD and GBP are configured in Chargebee, and then these currencies should be available in QuickBooks too.

c. Preferences: Chargebee will check if

- 'Automatically Employ Credits' choice is disabled.

- 'Custom Transaction Numbers' is enabled.

If not, you should change the settings in QuickBooks to proceed.

4. Set Reconciliation

If you have Stripe Payment Gateway enabled, then you can choose to follow Chargebee's recommended Payment Reconciliation method.

Note:

If you lot do non have Stripe gateway enabled, then y'all will not see this pick during the setup.

If you accept Stripe gateway enabled but wish to handle reconciliation on your own, yous tin can skip this stride.

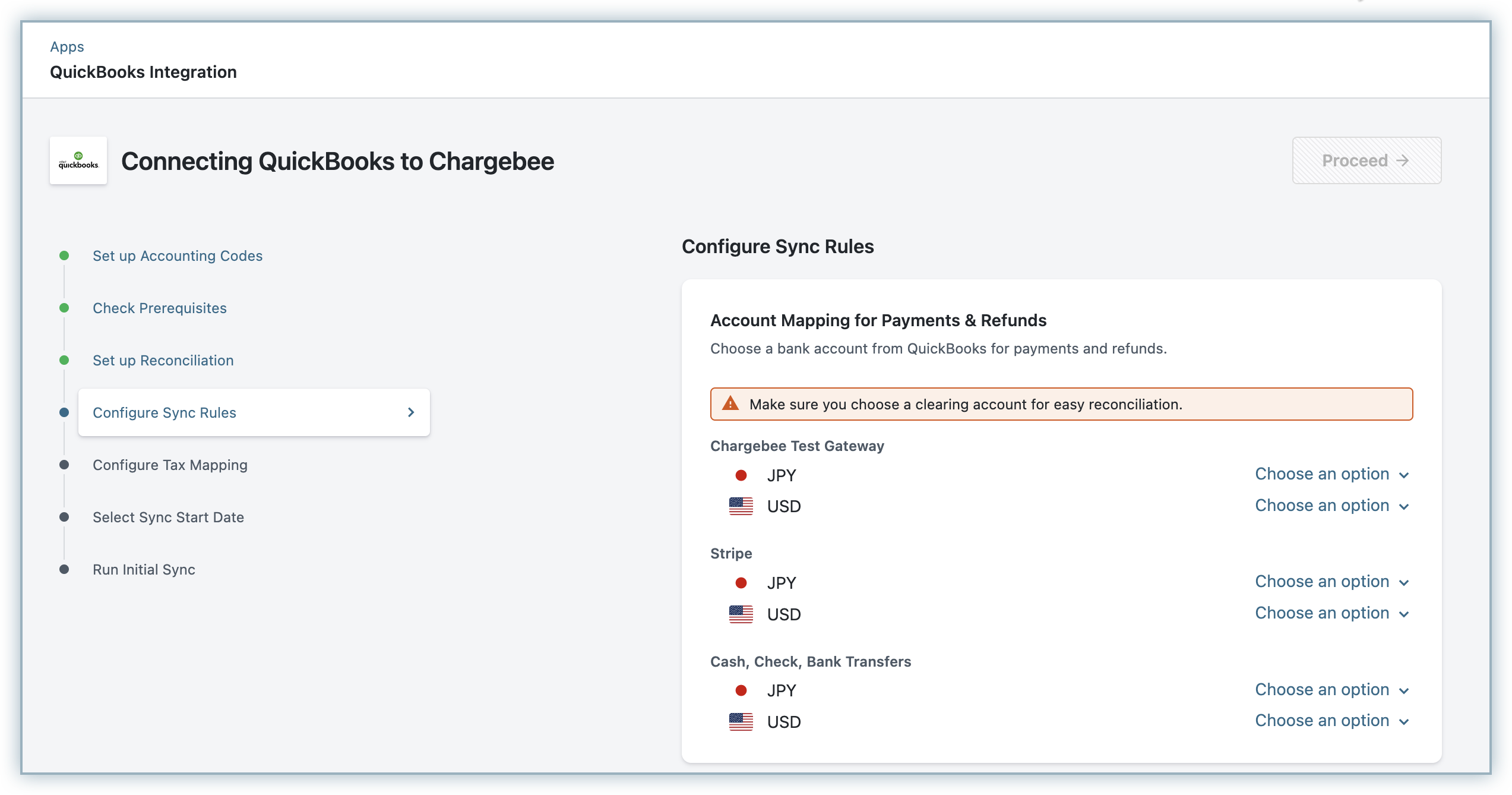

five. Configure Sync Rules

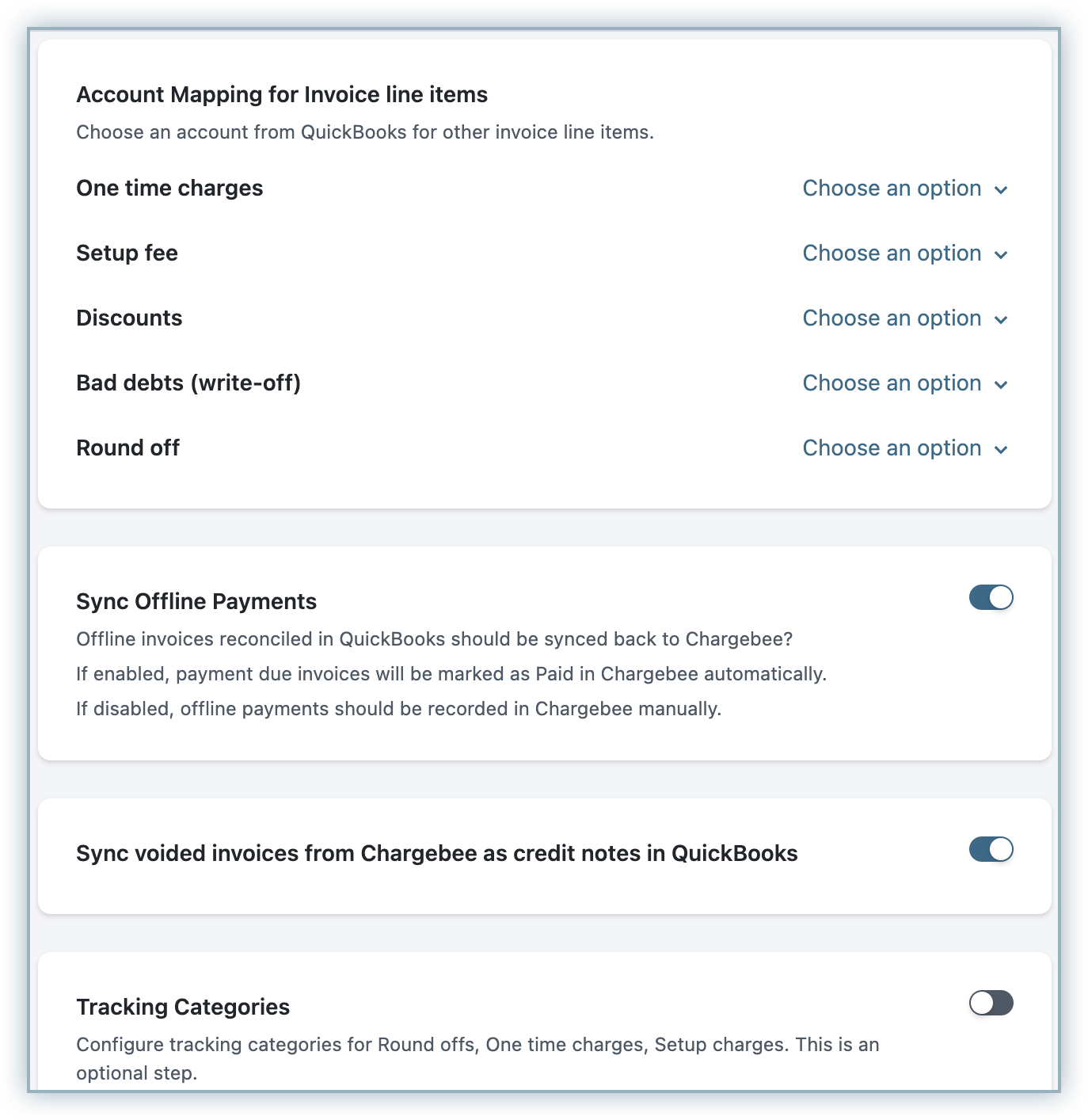

a. Provide Account Mapping

- Plan/Addon Price Points: Tin be mapped to specific GL Accounts in QuickBooks. This mapping is captured in the Production Catalog > Plan/Addon > Select a Plan/Addon Price Signal and enter the GL Account Proper name.

- Payments & Refunds: Payments /Refund transactions recorded in Chargebee. For Reconciliation purposes, yous tin can select a clearing /undeposited funds account. If you have multiple currencies or payment gateways or payment methods enabled, y'all tin choose a specific payments business relationship.

- Circular offs: If at that place is a difference in the invoice total calculation between Chargebee and QuickBooks, and then Chargebee will add together a round off item automatically, you can choose a GL account to which round offs should be mapped.

- Once charges: Ane time/ Adhoc charges created in Chargebee tin be mapped to a specific account in QuickBooks.

- Discounts: Select an account to map Discounts/ Cost of Goods (COGs) in QuickBooks. You can map multiple discount items to a single GL Account or you can choose to map each Discount item to specific GL Accounts. Contact Chargebee Support to help you with this mapping.

- Bad debts (write-offs): Yous can choose where Bad Debts should be mapped in QuickBooks.

Caution! If you make any changes to the GL Account Name in your QuickBooks business relationship anytime subsequently the integration is set upwards, y'all demand to update them in Chargebee as well. Failing to exercise so could through a sync fault.

b. Sync Offline Payments

When offline payments are read from the bank argument and reconciled against open invoices in QuickBooks, these payments can be read, synced back to Chargebee. The payment_due invoices will be marked equally Paid in Chargebee. You lot can choose to enable this feature or non.

c. Voided invoices as Credit Notes

Invoices tin be voided in Chargebee, simply cannot be voided in QuickBooks via API. Y'all tin can cull to sync these voided invoices as Credit Notes in QuickBooks. If not enabled, you should update the invoices manually in QuickBooks, Chargebee volition non void the invoices in QuickBooks.

d. Enter Tracking Categories

If you accept setup Classes in QuickBooks, y'all tin can enter the tracking categories for i-time charges, discounts and round-off.

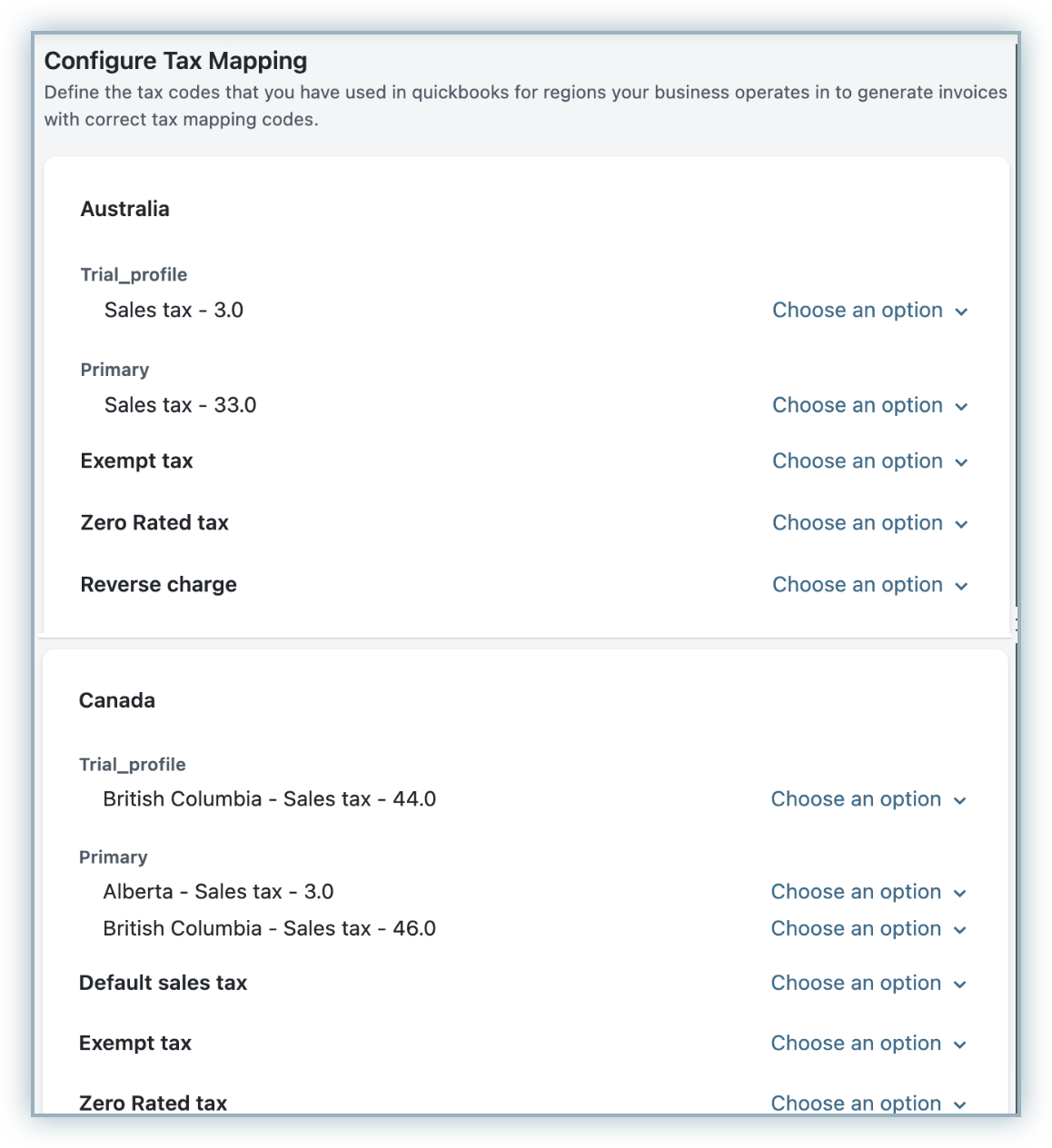

half-dozen. Setup Taxes

If you are using United states edition of QuickBooks (or Global edition):

Chargebee will create Tax Rates in QuickBooks automatically. Providing revenue enhancement code-mapping for US is a tedious procedure.

If you are using a Canada, Commonwealth of australia, New Zealand, South Africa, Singapore edition of QuickBooks:

You tin select from the listing of default tax rates created in QuickBooks

| Category | Select a Tax Charge per unit from QuickBooks |

| Sales | Select a Revenue enhancement lawmaking to map all your taxable sales, for instance, New Zealand - 15% GST. |

| Exempt | Select a Taxation code to map sales exempt from taxes for - Client or Products tin can exist exempt |

| Export | Select a Tax code to map sales to any other country outside your taxable region |

| Reverse Charge | Select a tax code for B2B sales with a valid Taxation registration number |

If you are using the UK edition of QuickBooks

UK organization in QuickBooks supports EU VAT Returns filing from inside the application. QuickBooks creates default Taxes to facilitate accurate VAT Liability reporting.

While configuring taxes in Chargebee, yous can select from one of the default Tax rates created in QuickBooks Uk version.

- If y'all are VAT MOSS REGISTERED - Chargebee will create new a Tax Agency: "MOSS" and create country specific Revenue enhancement Rates (MOSS Spain, MOSS France etc) based on which country the sale is fabricated to. This is the recommended approach by QuickBooks.

- If you lot are not VAT-MOSS REGISTERED - Chargebee volition allow you to select taxes from the default rates created in QuickBooks.

seven. Select Sync Start Engagement

Select a date from which invoices generated in Chargebee should be synced to QuickBooks.

Y'all tin choose from 1 of the following options:

- Sync all invoices

- Sync invoices from a specific date

If you choose to sync from a specific appointment, Invoices and related records from the specified date will but be synced to QuickBooks.

Caution!

- If in that location are Invoices and related records in Chargebee that are created earlier the date y'all specify, they will not be synced and y'all could see a sync fault. You can update the respective invoices manually in QuickBooks or contact us to ignore these invoices in subsequent sync.

- If there are updates to invoices, or credit notes are created for those invoices created before the specified appointment, you should update those records in QuickBooks manually.

eight. Run Initial Sync

Once the configuration is complete, you can begin with the sync. Chargebee will sync first 10 invoices but, to ensure the mapping, conventions and sync criteria align with your requirements.

We recommend that you review these invoices in QuickBooks. If the sync works as expected, you can click on the Sync All Records option and proceed or make the required changes.

QuickBooks setup is now complete.

Sync Preferences

Afterwards you run the sync, you tin can view the last sync details forth with errors institute during sync if any:

Sync At present

For on-demand sync, you can push button data from Chargebee to QuickBooks immediately.

Enable/Disable Automobile Sync

Subsequently setting upward the integration, yous can schedule to sync all the data to QuickBooks on a daily basis automatically. Invoices and related information will be synced to QuickBooks once in every 24 hrs. Y'all can choose to disable auto-sync if required.

Manage Mapping

You lot tin can edit the configuration details provided equally part of integration setup process:

- Edit the GL Account mapping

- Enable or disable offline payment sync from QuickBooks to Chargebee

- Edit tracking categories

Manage Tax Mapping

You can modify the tax codes selected during the setup process. If you have added taxation regions in your Chargebee settings, you tin can provide the new tax codes here.

Unlink

In case you want to stop syncing information from Chargebee to QuickBooks, you lot can Unlink the integration.

Chargebee will remove/update the hallmark and configuration as per the following:

For Examination Sites:

- Authentication details will be removed

- Sync configuration and GL account mapping will exist removed

- If yous reconnect to the same QuickBooks Visitor, the invoice mapping will not be retained.

For Live Sites:

- When you unlink, the invoice data mapping between Chargebee and QuickBooks will remain intact.

- In case yous connect to the same arrangement again, the data already synced will not be pushed to QuickBooks.

- In case yous want to connect to a different company, contact [electronic mail protected] .

Note

- If yous want to update details, please do so in Chargebee; the modifications will be synced to QuickBooks in a subsequent update.

- We recommend that you make the changes in Chargebee, such that data is consistent in both systems.

Sync Offline Payments (QuickBooks to Chargebee)

You tin can choose to retrieve the offline payments into Chargebee(or not), with the Sync Offline Payments option.

Caution!

When Sync Offline Payments is not enabled and you make an offline payment in QuickBooks confronting a payment due invoice in Chargebee, you would have to manually record a payment against the invoice in Chargebee besides. Declining to do so could throw an mistake message "The invoices linked to this payment do not match". You can manually correct this in QuickBooks.

With the Sync Offline Payments option enabled, Chargebee will read the transaction in QuickBooks, call back the transaction and marking the invoice as PAID, so you need not record a payment in Chargebee manually.

Note:

The substitution rate applied in QuickBooks is not imported into Chargebee when the offline payment is imported.

- Chargebee syncs the invoices to QuickBooks.

- The bank statement is downloaded into QuickBooks, for reconciliation.

- When y'all reconcile offline payments confronting payment due invoices in QuickBooks, QuickBooks marks the invoice equally PAID.

- Chargebee will read these payments, create the transactions in Chargebee and mark the payment_due invoices every bit PAID.

Reconciliation

Note:

Simply applicable for sites which take Stripe gateway configured.

Chargebee recommends the following payment reconciliation method:

- Create a clearing business relationship in QuickBooks

- Map payments/refunds to this immigration business relationship

- Generate the gateway statement from Chargebee

- Upload it into the clearing account in QuickBooks

- Run Chargebee's Reconciliation Google Chrome Plugin to reconcile bank statement and transactions in QuickBooks automatically

Read more than well-nigh Chargebee'south reconciliation process.

Was this article helpful?

Cheers for your feedback!

How tin nosotros improve information technology?

Source: https://www.chargebee.com/docs/2.0/quickbooks-config.html

0 Response to "Quickbooks Transaction No Reads Recon but I Cannot Apply Payment to the Invoice"

Post a Comment